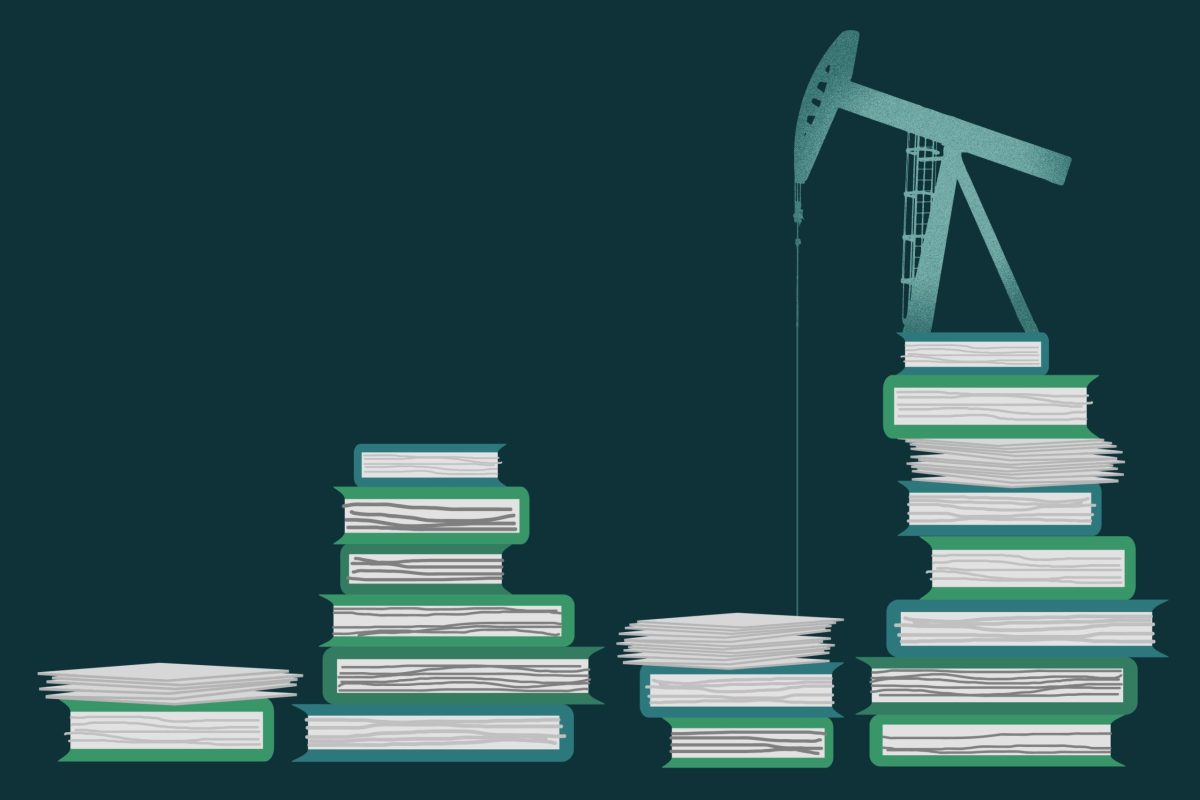

More than a year after the California State University Board of Trustees voted to divest from fossil fuels, Cal Poly’s endowment has maintained its investments in the fossil fuel industry thanks to a loophole in the CSU’s new policy.

On Oct. 6, 2021, the CSU Board of Trustees voted to start divesting from fossil fuels. At the time, the CSU system had $162 million worth of direct fossil fuel investments.

Since then, the number of direct investments in fossil fuels that the CSUs hold has decreased by around $111 million, according to Cal Matters. However, one key carveout was made in the pledge to divest: Mutual funds were excluded. Mutual funds are large pools of financial capital that are operated by a broker who chooses a variety of securities, derivatives and other financial instruments to invest other investors’ money in.

University spokesperson Keegan Koberl told Mustang News that $11 million, or 3.9%, of the foundation’s “diversified mutual fund holdings are comprised of energy sector securities (though not necessarily all are fossil fuel companies).”

According to the 2021-2022 audited operating budget of the Cal Poly Foundation the university still has $21.7 million invested in mutual funds that include direct and indirect investments in fossil fuel companies. The Cal Poly endowment holds a $21.7 million investment in the Pacific Investment Management Company (PIMCO) Total Return Fund, the PIMCO High Yield Fund and the PIMCO Foreign Bond Fund. All three mutual funds have a variety of direct investments in fossil fuel companies, related industries and indirect investments in financial instruments and institutions that have investments in fossil fuel companies.

According to a report published by Reclaim Finance, a fossil fuel watchdog group, PIMCO was found to have no coal, oil or natural gas policy. The same report found that PIMCO was among the top three asset managers holding fossil fuel bonds, holding a total of $17 billion worth of fossil fuel bonds.

Allianz Capital, the firm that owns PIMCO, supported a resolution by TotalEnergies, a global energy company, to push the company to reach carbon neutrality by 2030. According to the PIMCO investor reports however, the company still holds bonds in fossil fuel companies such as Shell that don’t mature until 2050.

“The Foundation follows the policy set by the CSU last year: since we cannot selectively exclude fossil fuel investments without sacrificing the investment objectives of our endowment,” Koberl wrote to Mustang News.

The endowment’s investment objectives are defined as the “fiduciary responsibility to maximize investment returns on its endowment consistent with the level of risk while ensuring good stewardship of these assets that will enable continued financial support to further the educational mission of the University,” according to the Cal Poly Foundation’s policy manual.

Fiduciary responsibility is the responsibility that a broker has to their investors’ money. Brokers must make a return on investment and the Cal Poly foundation has very few strings attached when it comes to how that make that return on investment.

“The Foundation has not adopted any policy regarding fossil-fuel securities, it purchases fossil-fuel-free mutual funds when they offer equivalent or superior investment profiles, compared to other funds,” Koberl said. “The Foundation does not have a policy that addresses purchases of individual securities.”

The Cal Poly endowment also contracts with the asset management firm Teachers Insurance and Annuity Association of America Kaspick (TIAA Kaspick) to manage its portfolio according to Koberl. TIAA Kaspick came under fire earlier this month after the group TIAA-Divest sent a letter on behalf of the United Nations Principles for Responsible Investment urging the asset manager to drop its $78 billion worth of fossil fuel investments. The firm is a major asset manager for other U.S. universities such as Princeton, Caltech, University of Oregon, Harvard and others, according to the TIAA Kaspick website.

“TIAA is committed to managing investments in line with a transition to a low-carbon economy. However, after due consideration, our view is that broad divestment from fossil fuels does not offer TIAA an optimal way to influence the policies and practices of issuers we invest in, nor is it the best means to produce long-term value for our investors and other stakeholders,” a spokesperson for TIAA Kaspick stated in response to the TIAA-Divest letter.

Beyond fossil fuel investments, the foundation also has no policy on investments that may violate U.S. sanctions.

“The Foundation cannot selectively divest or disaggregate currency investments, securities, derivatives, bonds, or any other financial instrument that may have a direct or indirect connection to the nations listed – Saudi Arabia, Russia, Qatar, Bahrain, Oman, the UAE, Iran, Azerbaijan, Turkmenistan – without compromising our investment objectives,” Koberl added.

In June of this year, PIMCO sent a “warning” to the US Treasury Department that sanctioning Russian government bonds would put PIMCO’s $1.8 billion investment in Russian bonds in jeopardy. The Treasury Dept. then decided against sanctioning Russian government bonds.

Cal Poly’s endowment still has a long road ahead of itself to decouple its investments from the fossil fuel industry.